Equity

Sundance Bay can provide joint venture equity for owners and developers of multi-family and commercial assets.

Equity

Sundance Bay can provide joint venture equity and preferred equity for owners and developers of multi-family and commercial assets.

Sundance Bay provides equity amounts between $2 million and $40 million per transaction to net lease developers and investors nationwide on a programmatic basis.

We provide joint venture equity on medical, industrial, retail, and self-storage assets, focusing on ground-up development, blend and extend transactions, and heavy value-add projects. Deals are structured as joint ventures and can be created to meet the needs of each project and developer. Approved projects have the majority of signed leases in hand, entitlements completed, and an investment timeline between 1 – 5 years. Sundance Bay has the capability of a large institution coupled with the speed and flexibility of friends and family capital and works with a variety of local and national tenants.

Parameters

Equity Check Size

$2-40MM per transaction

Deal Size

$4-150MM per transaction

Target Asset Classes

Medical, Retail, Industrial, Self Storage

Position

LP and GP equity

Structure

Joint Venture Equity

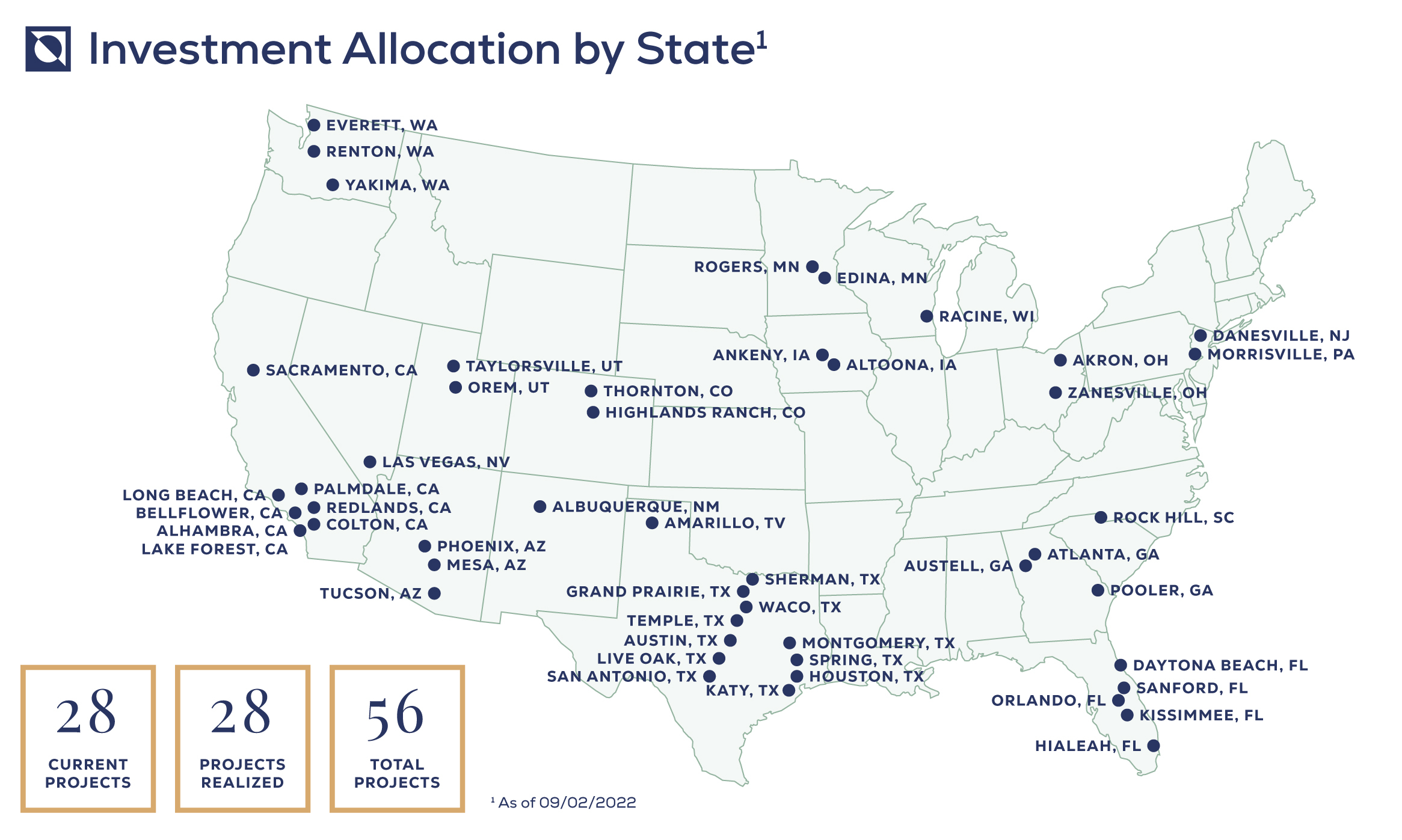

Geography

National

Target Hold Period

1-5 years

Profile

Development; Heavy Value Add

Leverage

60-75%

Contact:

Lance Frame (NNN)

818- 726-7473

Matt Lish (Self Storage)

702-334-5222