Net Lease Investments

Sundance Bay Net Lease Investments provides joint venture equity capital to net lease real estate developers nationwide. Our deep understanding of the net lease industry creates both value for the sponsors we partner with and the investment returns we generate.

We are a programmatic source of joint venture equity for ground-up development projects, blend and extend transactions (single asset or portfolios), and value-add net lease acquisitions nationwide. Sundance Bay is a direct source of GP and LP equity on deal sizes between $4MM—$150MM.

The principals of Sundance Bay Net Lease Investments collectively have capitalized over $2 Billion of new projects. Some of the tenants we’ve been involved with include: Dutch Bros Coffee, Tesla, Cadence Education, Wawa, Rite Aid, 7-Eleven, Chipotle, CVS, AutoZone, Fresenius, KidneySpa, Popeyes, Family Dollar, Carl’s Jr, Kiddie Academy, Walgreens, Starbucks, Ace Hardware, Advance Auto, and many more.

Net Lease Investments

Sundance Bay Net Lease Investments provides joint venture equity capital to net lease real estate developers nationwide. Our deep understanding of the net lease industry creates both value for the sponsors we partner with and the investment returns we generate.

We are a programmatic source of joint venture equity for ground-up development projects, blend and extend transactions (single asset or portfolios), and value-add net lease acquisitions nationwide. Sundance Bay is a direct source of GP and LP equity on deal sizes between $4MM—$150MM.

The principals of Sundance Bay Net Lease Investments collectively have capitalized over $2 Billion of new projects. Some of the tenants we’ve been involved with include: Dutch Bros Coffee, Tesla, Cadence Education, Wawa, Rite Aid, 7-Eleven, Chipotle, CVS, AutoZone, Fresenius, KidneySpa, Popeyes, Family Dollar, Carl’s Jr, Kiddie Academy, Walgreens, Starbucks, Ace Hardware, Advance Auto, and many more.

Equity Program

Sundance Bay provides equity amounts between $2 million and $40 million per transaction to net lease developers and investors nationwide on a programmatic basis. Deals are structured as joint ventures and can be created to meet the needs of each project and developer. Sundance Bay provides joint venture equity on medical, industrial, retail, and self storage assets with a focus on ground-up development and heavy value-add projects. Approved projects have the majority of signed leases in hand, entitlements completed, and an investment timeline between 1 – 5 years. Sundance Bay works with a variety of local and national tenants.

Sundance Bay Net Lease Investments by the numbers:

$602M

*As of 12/31/2024

17

*As of 12/31/2024

68

*as of 12/31/2024

Our Parameters

Property Type

Net lease (single and multi-tenant)

Deal size

$4MM – $150MM

Asset Class

Medical, Industrial, Retail, Self Storage

Type

Development, Blend & Extend, Value-add

Location

Nationwide

Investment Duration

1-5 years

Sundance Bay Net Lease Investments

Our Net Lease platform provides joint venture equity capital to real estate developers nationwide

Single or multi-asset syndications.

Net lease equity investments for ground-up development projects, blend and extend transactions (single asset or portfolios), and value-add acquisitions.

Target hold period of 12 – 60 months (average realized hold period of 18.4 months).

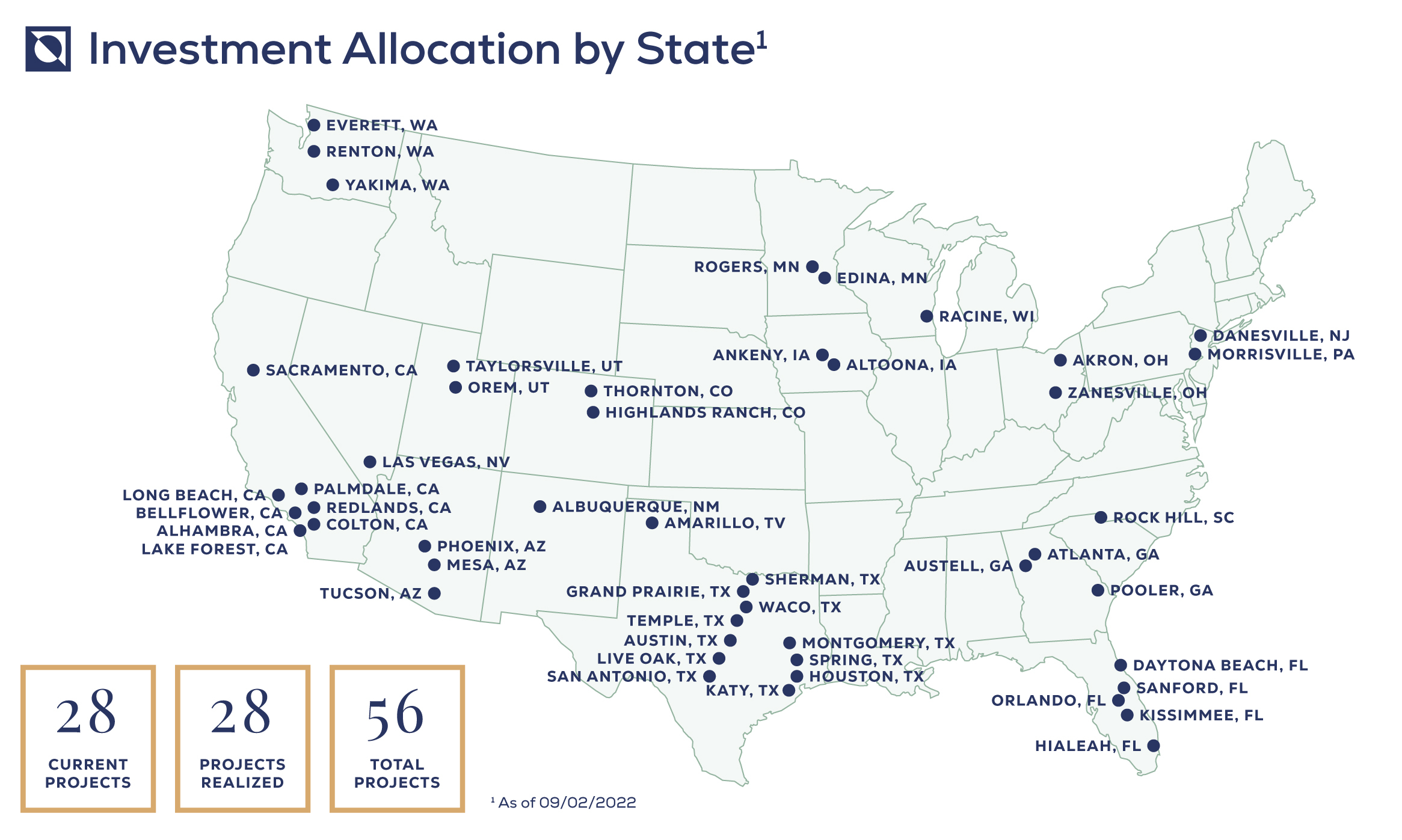

Aimed at acquiring and developing medical, industrial, self storage, and internet-resistant retail assets with credit tenants nationwide (56 projects funded across 17 states).

*as of 9/2/2022

Sundance Bay Net Lease has worked with a variety of national tenants including: Dutch Bros Coffee, Tesla, Rite Aid, 7-Eleven, Chipotle, CVS, AutoZone, Popeyes, Family Dollar, Walgreens, and Starbucks.

Sundance Bay believes their network represents best-in-class Sponsors who we feel have a competitive edge in their respective markets. Projects are entitled and zoned before closing with significant leasing in hand prior to closing.