Multifamily Properties

Multifamily properties make up an important core of Sundance Bay’s assets. Since 2012, we’ve acquired over 10,000 apartment units, tackling heavy renovations and creating fantastic places to call home. We also add value by using our own in-house asset management and renovations teams to improve and stabilize each asset, maximizing profitability and addressing challenges head-on. We’re proud of our properties and the hard work we’ve put into them.

Multifamily Properties

Multifamily properties make up an important core of Sundance Bay’s assets. Since 2012, we’ve acquired over 10,000 apartment units, tackling heavy renovations and creating fantastic places to call home. We also add value by using our own in-house asset management and renovations teams to improve and stabilize each asset, maximizing profitability and addressing challenges head-on.

We’re proud of our properties and the hard work we’ve put into them.

Our process

Acquiring an apartment building requires the ability to source and analyze the right kind of opportunities.

We source on and off-market deals through a variety of channels, including property owners, brokers, financial institutions, capital advisors, and on-site management, among others. Through these relationships and channels we are able to maintain a healthy pipeline of multifamily deal flow.

When we identify an investment opportunity, we conduct a basic analysis to determine if the deal warrants further investigation. At this early stage of due diligence, we review the local market, demographics, and competition and prepare a budget and pro forma to determine the upside potential from applying appropriate value-add improvements.

The acquisition of an asset is only the beginning of the value-add process. The real work begins with the implementation of the redevelopment plan.

Each asset that we acquire is unique and requires us to analyze various redevelopment options. We take into account the appearance, vintage, brand integrity, asset preservation, and market conditions to develop a plan that is asset-specific and provides the biggest impact towards achieving our desired returns.

Once the plan is established, we:

- Negotiate and execute design and construction contracts

- Refine the redevelopment budget and timeline

- Coordinate interior upgrades with current vacancies and apartment turns to minimize rental income downtime

- Execute the exterior improvements and amenities

- Review ongoing the budget, schedule, and risk management

Our in-house asset management team gives us complete visibility into the portfolio and allows us to maximize the profitability of each multifamily property.

We aim to identify best in class property managers that are best suited to partner with us to execute the business plan for each property. We closely monitor property operations through frequent site visits. We conduct monthly financial reviews and identify opportunities for revenue growth and expense savings. We consistently evaluate marketing, leasing, renewals, vendor contracts, capital projects and staff performance, among other items.

As we effectively renovate and manage our properties, we feel that we attract and retain residents who are proud to call our communities home.

Sundance Bay Multifamily by the numbers:

$1.5B+

management

*as of 6/30/2022

58

*as of 6/30/2022

10,700+

*as of 6/30/2022

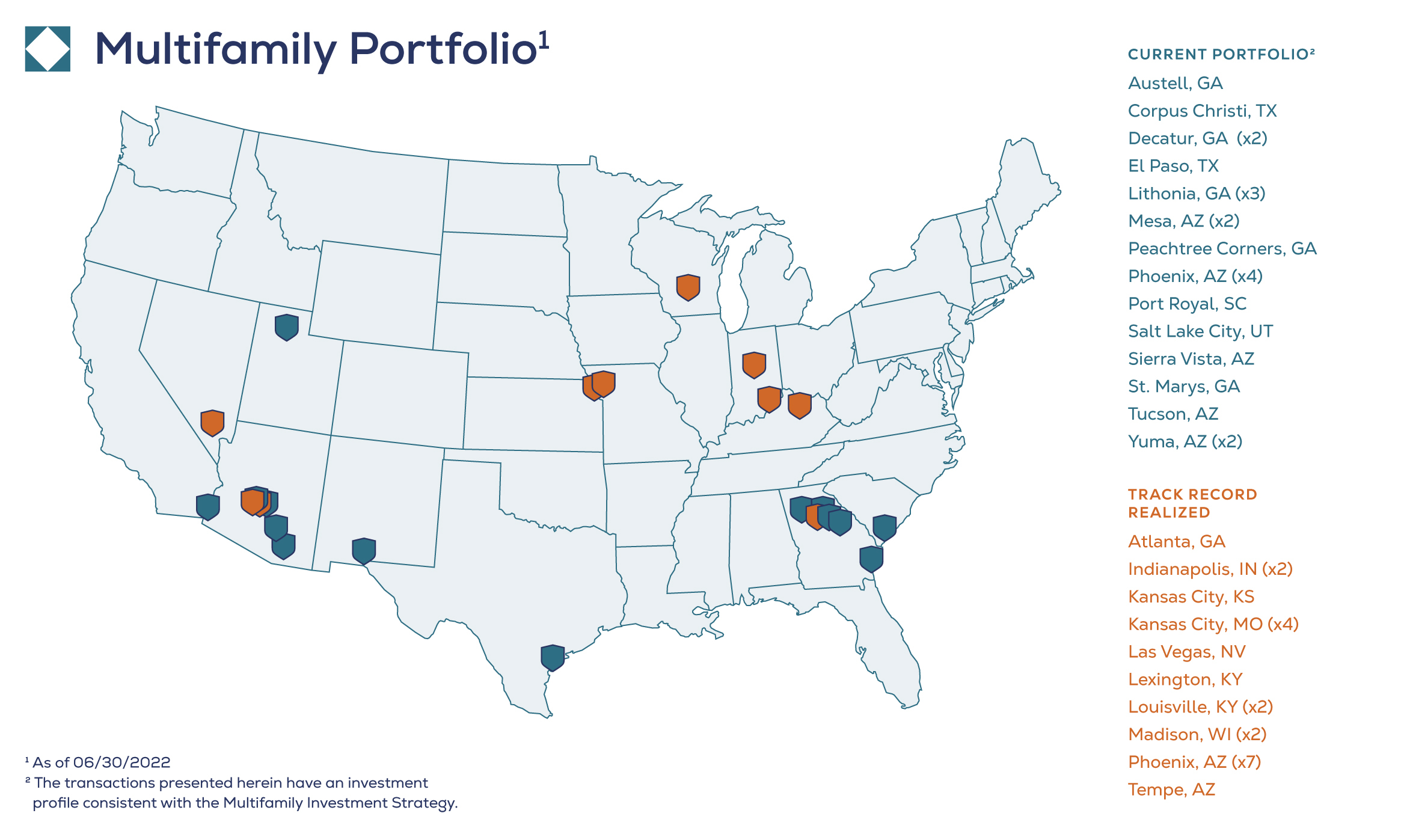

Our Portfolio

Sundance Bay Multifamily Strategy

Our Sundance Bay Multifamily strategy acquires, renovates, and repositions multifamily apartment communities.

Multifamily equity investments with a core-plus/value-add strategy.

20+ current assets spread across 5 states.

High-growth secondary market approach aimed at Class B/C “workforce” housing and secondary/tertiary markets (data-driven focus on select markets: UT, AZ, TX, GA, FL, etc.)

1031 tax deferred exchanges and depreciation help to shelter cash flow. REIT structure allows for 20% pass through deduction.

*Sundance Bay does not provide tax advice to investors, please seek the advice of your tax adviser in relation to the application of tax issues regarding such structures.

Vertically integrated operator (as opposed to the allocator model) with real estate professionals based in markets where we invest.